On May 17, 2013 Governor Rick Scott signed into law one of the main agenda goals of his term in office. Specifically, Sec. 212.08(7)(kkk), Florida Statutes (F.S.), was enacted with an effective date of April 30, 2014 to allow a 100% exemption for machinery and equipment purchased for the use in Florida based manufacturing and processing companies. A simply exemption certificate can be supplied to the vender selling the equipment and no sales or use taxes are theoretically due. If your company or your clients are in the manufacturing industry, then this is a huge win. However, there are a few nuances of the law to which you should pay attention. For example, by the terms of the law, the exemption will expire on April 30, 2017 if not extended. We will discuss these nuances as well as provide the full text of the new law later in this article.

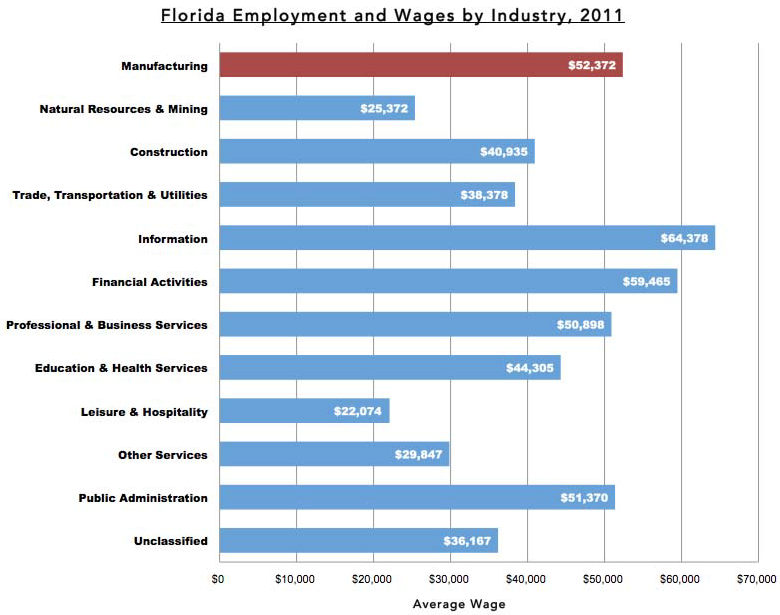

It should be noted this law is very, very long overdue and the opponents of this bill should be ashamed of themselves for putting up a challenge this long. Even though Manufacturing jobs provide substantially higher salaries that the medium salaries in Florida ($52,000 vs $40,000) and dramatically higher than the two largest industries in Florida Construction ($40,000) and Leisure/Hospitality ($22,000), Florida has far fewer manufacturers than most of the states in the country. And, of course, the members of the Tea Party reading this article will love the fact that the average government employee makes $51,000 a year, which more than 25% over the average salary in the state.

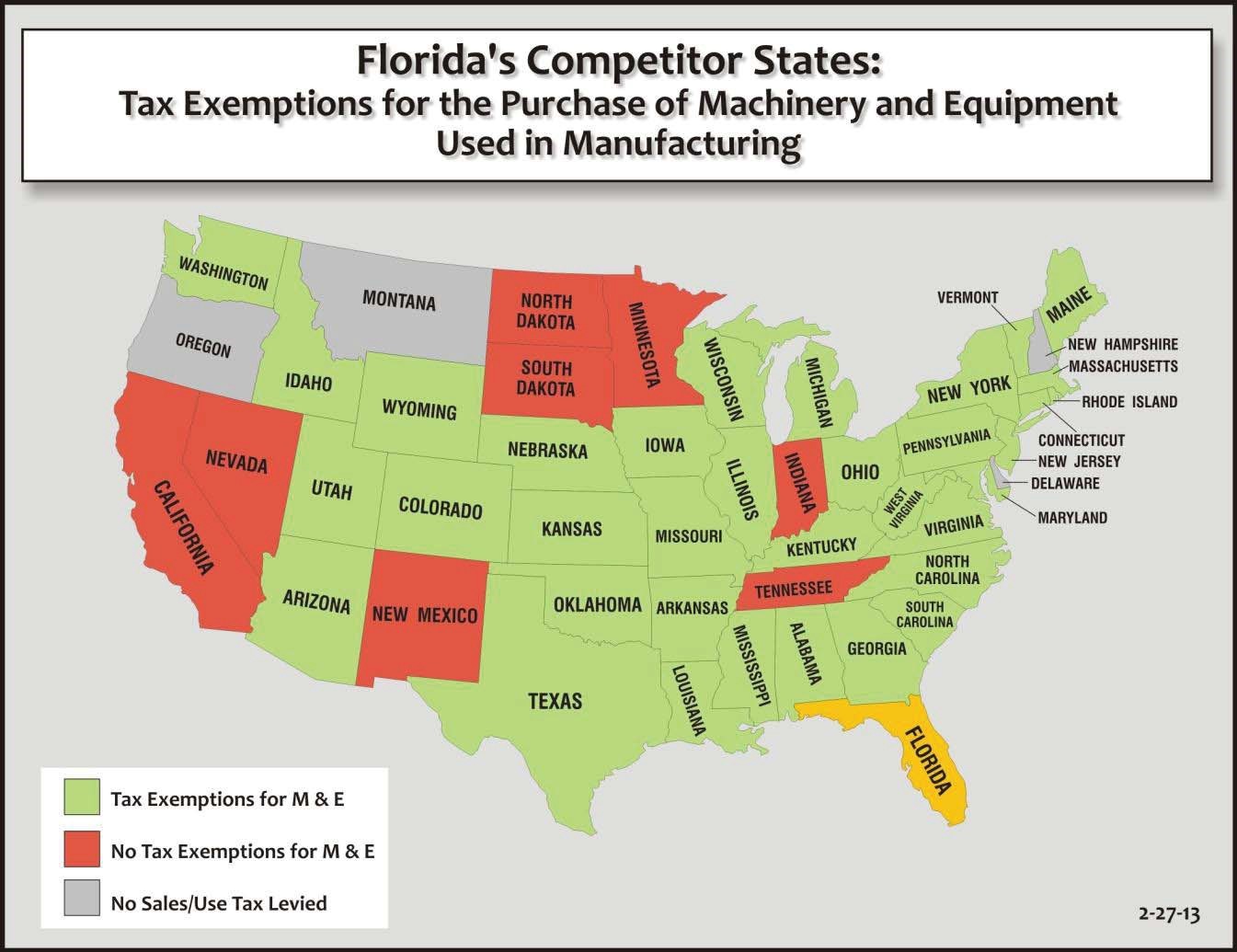

Florida has a lot to offer a potential manufacturing company from great roads and other forms of transportation, well educated population, vast areas of undeveloped, cheap land, and a continuously growing population. If you had to choose a place to relocate your family, then who wouldn't want to choose Florida? Potential manufacturing business owners faced with an equal cost option would seriously consider Florida for the location of their new business with the exception of one problem – the costs have not been equal. As you can see from the chart below, Florida is one of the few states in the country that did not already exempt machinery and equipment from sales tax. This simple lack of foresight on Florida's part has been keeping thousands of very high paying jobs out of Florida. Thanks to Governor Rick Scott and a handful of other business savvy politicians, the game just changed.

If you think about it, machinery and equipment used in manufacturing should not be taxed anyway. Sales and use tax is supposed to be a consumption tax. Originated by Mississippi in 1930 to battle lost state income tax revenues during the Great Depression, Sales and Use Tax is supposed to be imposed on the final consumers of goods and services. Manufacturing equipment makes the goods that will eventually be subject to sales and use tax and the cost of the manufacturing equipment is built into the cost of goods sold. So, effectively, the cost of the manufacturing equipment has always been subject to sales tax through the goods produced. This is the reasoning behind why almost every state in the deep south already exempts machinery and equipment from sales and use tax.

One of the primary reasons why it has taken this long for the sales tax exemption on machinery and equipment this long to get passed (and still only for 3 years) is the disinformation pushed into the public's eye by the state's vast liberal media industry. The problem has been that our extremely liberal news media outlets in Florida have seen exemptions granted to businesses as some type of corporate welfare. Publications like the Orlando Sentinel, the St. Pete Times (now the Tampa Bay Times), and the Miami Herald have spent vast amount of time and resources writing article after article filled with misinformation about business tax incentives that create thousands of jobs and pump hundreds of millions of dollars into the Florida economy (and not into other states). Those dollars placed into Florida manufacturing employees' hands get spent at other local businesses from restaurants, car dealers, retail stores, and other business owned by Floridians that employee Floridians. The salaries also go to pay local property taxes as well as sales and use tax. In other words, everyone benefits when we incentivize a new business to move to Florida, especially a high wage business like manufacturing. These liberal news article somehow miss the concept of money is flowing into Florida dramatically more than the business incentives used to draw the manufacturing jobs to the states. Examples of the extreme left slanted news articles are not hard to find, such as:

"Report Calls Florida Business Incentives Corporation Welfare", by Toluse Olorunnipa, Miami Herald, February 5, 2013.

"Florida Can Ill Afford Corporate Welfare," by Dana Summers, Tampa Bay Times, December 23, 2012

And let's not forget my personal favorite, "Video-Game Company Helps Write Florida Tax-Incentive Law, Saves Itself Millions," by Jason Garcia, Orlando Sentinel, December 30, 2012 in which one of the most liberal newspapers in the state published a long, harsh article about EA Games getting a little over $9 million in tax breaks (not cash, just taxes that they don't have to pay) while burying at the very, very end of the article the 6,000 Floridians employed by the company for a whopping total of over $480,000,000 in salaries. Yes – that is four hundred and eighty million dollars of salaries paid to Floridians, which makes the tax incentives less than 2% of the salaries pumped into the local economy. I'll get off my soap box now and get back to the topic at hand – the new 100% exemption on machinery and equipment purchased for use the Florida manufacturing industries.

The exact verbiage of the bill signed by the governor is provide below.

Sec. 212.08(7)(kkk) Certain machinery and equipment.–

1. Industrial machinery and equipment purchased by eligible manufacturing businesses which is used at a fixed location within this state for the manufacture, processing, compounding, or production of items of tangible personal property for sale shall be exempt from the tax imposed by this chapter. If at the time of purchase the purchaser furnishes the seller with a signed certificate certifying the purchaser's entitlement to exemption pursuant to this paragraph, the seller is relieved of the responsibility for collecting the tax on the sale of such items, and the department shall look solely to the purchaser for recovery of the tax if it determines that the purchaser was not entitled to the exemption.

2. For purposes of this paragraph, the term:

a. "Eligible manufacturing business" means any business whose primary business activity at the location where the industrial machinery and equipment is located is within the industries classified under NAICS codes 31, 32, and 33. As used in this subparagraph, "NAICS" means those classifications contained in the North American Industry Classification System, as published in 2007 by the Office of Management and Budget, Executive Office of the President.

b. "Primary business activity" means an activity representing more than fifty percent of the activities conducted at the location where the industrial machinery and equipment is located.

c. "Industrial machinery and equipment" means tangible personal property or other property that has a depreciable life of 3 years or more and that is used as an integral part in the manufacturing, processing, compounding, or production of tangible personal property for sale. A building and its structural components are not industrial machinery and equipment unless the building or structural component is so closely related to the industrial machinery and equipment that it houses or supports that the building or structural component can be expected to be replaced when the machinery and equipment are replaced. Heating and air conditioning systems are not industrial machinery and equipment unless the sole justification for their installation is to meet the requirements of the production process, even though the system may provide incidental comfort to employees or serve, to an insubstantial degree, nonproduction activities. The term includes parts and accessories for industrial machinery and equipment only to the extent that the parts and accessories are purchased prior to the date the machinery and equipment are placed in service.

3. This paragraph is repealed effective April 30, 2017.

There are a few specifics to note when reading through the new statute. First, the purchaser must fall under one of the NAICS Codes specified by the statute, specifically 31, 32, or 33. These are the general codes for most types of manufacturing and processing industries, and you can find a free listing of each of the sub-codes at the NAICS Code web site. Second, the purchaser must not only be in a manufacturing industry specified under NAICS codes 31, 32, or 33, but the qualifying business activities must also be at least 50% of the company's activities. So companies that do some processing or manufacturing but the business is primarily in some other industry will not qualify.Planning note: separating the manufacturing division of the business into a separate legal entity may achieve a more favorable tax result. Even a separate legal entity that is disregarded for Federal income tax purposes should achieve the desired results. Third, the statute seems to create some uncertainty about machinery and equipment that might be considered part of the building, which I'm sure will create a world wind of tax controversy down the road.

While it is painfully obvious that the new law is meant to make it extremely easy for manufacturing businesses to qualify for the exemption, it will be some time before the Department begins promulgating administrative rules that will no doubt muddy the waters in this area. Just ask any Florida based manufacturer that has been through a Florida sales and use tax audit in the last 5 years and they will tell you that the Florida Department of Revenue does a very good job at making manufacturers feel very unwelcome in the sunshine state. Perhaps the next job for our business friendly governor will be to toughen up the Florida Taxpayer Bill of Rights to reel in the aggressive tactics currently being utilized by our draconian1 comrades in Tallahassee.

One final note. There are groups in Florida that believe the legislature should have had a 2/3rds majority to pass this legislation, which did not happen. So there is a chance that this legislation will face legal challenges before the effective date of April 30, 2014.

If you would like to learn more about the new manufacturing sales and use tax exemption statute or have any other questions about Florida sales and use tax matters, then please feel free to contact one of our attorneys for a FREE INITIAL CONSULTATION. If we can answer your questions and concerns in a quick phone call, then we are glad to do it. If you need more help or are being harassed by the Florida Department of Revenue, then you know who to call.

ABOUT THE AUTHOR: MR. SUTTON IS A FLORIDA LICENSED CPA AND ATTORNEY AND A SHAREHOLDER IN THE LAW FIRM the Law Offices of Moffa, Sutton, & Donnini, P.A. MR. SUTTON IS IN CHARGE OF THE TAMPA OFFICE FOR THE FIRM AND HIS PRIMARY PRACTICE IS FLORIDA SALES AND USE TAX CONTROVERSY. MR. SUTTON WORKED FOR THE STATE AND LOCAL TAX DEPARTMENT OF A BIG FIVE ACCOUNTING FIRM FOR A NUMBER OF YEARS AND HAS BEEN AN ADJUNCT PROFESSOR OF LAW AT STETSON UNIVERSITY COLLEGE OF LAW SINCE 2002 TEACHING STATE AND LOCAL TAX, ACCOUNTING FOR LAWYERS, AND FEDERAL INCOME TAX I. YOU CAN READ MORE ABOUT MR. SUTTON IN HIS FIRM BIO.

ABOUT THE AUTHOR: MR. SUTTON IS A FLORIDA LICENSED CPA AND ATTORNEY AND A SHAREHOLDER IN THE LAW FIRM the Law Offices of Moffa, Sutton, & Donnini, P.A. MR. SUTTON IS IN CHARGE OF THE TAMPA OFFICE FOR THE FIRM AND HIS PRIMARY PRACTICE IS FLORIDA SALES AND USE TAX CONTROVERSY. MR. SUTTON WORKED FOR THE STATE AND LOCAL TAX DEPARTMENT OF A BIG FIVE ACCOUNTING FIRM FOR A NUMBER OF YEARS AND HAS BEEN AN ADJUNCT PROFESSOR OF LAW AT STETSON UNIVERSITY COLLEGE OF LAW SINCE 2002 TEACHING STATE AND LOCAL TAX, ACCOUNTING FOR LAWYERS, AND FEDERAL INCOME TAX I. YOU CAN READ MORE ABOUT MR. SUTTON IN HIS FIRM BIO.

Note: The charts included herein were taken directly from "Building Up Florida Manufacturing: A Plan For Florida Jobs," by Governor Rick Scott (undated).

See, "Gov. Scott Signs Constitutionally Murky Tax Cut, Touts Jobless Rate Down to 7.2 Percent," The Florida Current, by Gray Rohrer, 05/17/2013

1 "Draconian" relates to Draco, a 7th-century B.C. Athenian statesman and lawmaker who implemented laws that prescribed extremely harsh punishment for almost every offense, quite often the death for even minor offenses.

ADDITIONAL RESOURCES

TIP 13A01-06 - Sales and Use Tax Exemption for Purchases of Industrial Machinery and Equipment

© 2013 All rights reserved – James H Sutton Jr CPA Esq