FL DOR DISCLOSES CONFIDENTIAL TAXPAYER INFO?

Our comrades in Tallahassee never cease to amaze. Apparently if your business gets behind in remitting sales tax, then the collections arm of the Florida Department of Revenue feel the legal restrictions on threats and disclosing taxpayer information is somehow not relevant any more. One Florida business owner found this out the hard way.*

We get calls all the time from business owners that have found themselves in hot water with the Florida Department of Revenue. These are usually very hard working, honest business owners that have run into hard times and somehow fell behind in remitting the monthly sales tax payments. One of these such phone calls was from a business owner that had been threatened by a local collections agent so much that he needed legal advice on whether the threats were real. Apparently the collections agent claimed that if the back payments were not made by within a few days that (s)he was going to immediately revoke the business's sales tax registration and close the restaurant down that day. The business owner requested seven extra days to pay the entire delinquent amount off, but the collection agent said that the business would be close down immediately if the amount was not paid by the specified date. This was the point that the business owner contacted me.

I advised the business owner that the matter was very serious and could result in many problems that he would not like, including criminal charges and yes - a revocation of his sales tax registration. However, I also advised that the collections agent's threats of immediately revoking the sales tax license were not true. A collections agent does not have that authority to immediately revoke a sales tax registration and it was unethical of the agent to threaten such action - and possibly a violation of the taxpayer's rights. Revoking a sales tax registration has due process requirements, which include a right to a hearing and would eventually need to be decided by a judge before the state could legally revoke the business's sales tax registration. I advised that the revocation process was not a process he wanted to go through, but that if he could come up with the full funds to pay this off before the state took the next step – setting up a revocation hearing - then there was a good chance the state would allow the business to get back into compliance fully. Either way, the collection agent would not have the authority to close the business as threatened.

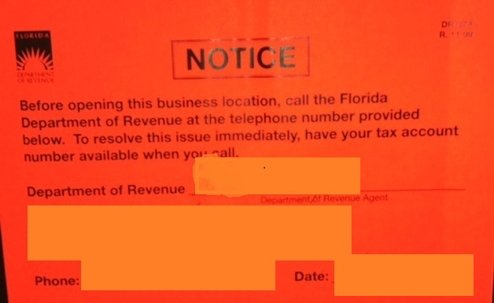

Within a couple of days of missing the "deadline," the collections agent decided to take matters into the agent's own hands. The owner of a popular restaurant located in a highly trafficked public location got to his restaurant find a notice attached to his front door. The notice said:

NOTICE

Before opening this business location, call the Florida Department of Revenue at the telephone number provided below. To resolve this issue immediately, have your tax account number available when you call.

Department of Revenue [collections agent name]

[address of the local DOR office]

Phone: (XXX) XXX-XXXX Date: [DATE OF THE NOTICE]

When the business owner arrived at work to find this rather revealing notice on the door, the employees AND the business's landlord were also there reading the information as well. Everyone assume that the Department of Revenue had shut down the business for some tax matter, exactly what the collections agent had threaten to do. Of course, the notice did not exactly say that. The notice was merely a threat with heavy implications. However, what the notice also did was reveal to the public that the business had tax problems with the Department of Revenue, which is very questionably a disclosure of confidential taxpayer information. There are a few legal means for putting the public on notice of tax problems, such a filing a tax warrant (lien), but where in the Florida statutes does it allow a collections agent to reveal a company has tax problems outside a tax warrant notice? Would there be legal consequences if the landlord refused to renew a lease based on this revealed taxpayer information? What if employees quit because they feared the restaurant was closing due to revealed tax concerns? What if the threat contributes to the restaurant closing? Could the disclosure of this taxpayer confidential information result in a law suit against the DOR? What about the employee doing the disclosing?

There are limitations on what the Department of Revenue can do and those limitations are there to protect the citizens of Florida. Just because a collections agent decides they don't like a situation does not mean that they can lie to taxpayers or reveal confidential information to induce a business owner into doing what the DOR agent wants them to do. I can only imagine that collections agents can get a little jaded when business owners constantly refuse pay amounts that are due, but this does not excuse false threats and disclosures of taxpayer information to the public. That is an abuse of power.

If you or someone you know is being threatened by the Florida Department of Revenue agent, then I suggest you take the matter very, very seriously. But do not believe everything that the collection agent says. If you have questions about your rights, obligations, or just need help navigating out of the minefield of sales tax obligations, then please pick up the phone to speak to one of our attorneys for a free initial consultation. Let us help you put this matter behind you as painlessly as possible.

ABOUT THE AUTHOR: Mr. Sutton is a Florida licensed CPA and Attorney and a shareholder in the law firm the Law Offices of Moffa, Sutton, & Donnini, P.A. Mr. Sutton is in charge of the Tampa office of the firm and his primary practice area is Florida sales and use tax controversy. Mr. Sutton worked in the State and Local Tax department of a "big five" accounting firm for a number of years and has been an adjunct professor at Stetson University College of Law since 2002 teaching State and Local Taxation, Accounting for Lawyers, and Federal Income Tax I. You can read more about Mr. Sutton in his firm BIO.

ABOUT THE AUTHOR: Mr. Sutton is a Florida licensed CPA and Attorney and a shareholder in the law firm the Law Offices of Moffa, Sutton, & Donnini, P.A. Mr. Sutton is in charge of the Tampa office of the firm and his primary practice area is Florida sales and use tax controversy. Mr. Sutton worked in the State and Local Tax department of a "big five" accounting firm for a number of years and has been an adjunct professor at Stetson University College of Law since 2002 teaching State and Local Taxation, Accounting for Lawyers, and Federal Income Tax I. You can read more about Mr. Sutton in his firm BIO.

* This article was published with the approval of the taxpayer involved in this situation.

© 2013 – James Sutton, all rights reserved