Florida is the only state in the United States that directly imposes sales tax on commercial rental payments. Specifically, Florida levies a sales tax at the rate of 5.7% for commercial rent and allows counties to levy an additional surtax that ranges from 0% to 2.5%. Identifying taxable rent is only the first step, however. Calculating the sales tax on commercial rent is more difficult than one would imagine.

[Looking for 2020 Florida sales tax rates on commercial rent? Click HERE]

Many rental agreements are structured between related parties in which the land and building are in a separate entity for asset protection purposes. In these situations, it is important to remember that there is no requirement for fair market value rent under Florida sales tax law. Therefore, with a little tax planning, business owners can see substantial sales tax savings in a rental agreement.

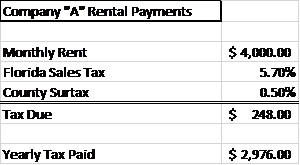

For example, Company A and Company B are owed by John Smith. Company A rents from Company B, the property owner of the property being rented. The rent is based on the fair market value of $4,000 a month. Sales tax due will be calculated as shown below.

Although Company A and Company B are both owned by John Smith, the companies are remitting over $2,976 in sales tax a year to the state of Florida for rent for moneys that are effectively moving from one pocket to the other. As such, even in a related party rental agreement, it may make sense to have a lease between the parties for a nominal amount.

Keep in mind the southern phrase, pigs get fat, but hogs get slaughtered. In other words, making the rent a $1 a year might entice the FL Department of Revenue to challenge the rental agreement. You would likely win if you crossed your t’s and dotted all your i’s, but fighting would be time consuming and expensive.

What catches a fair amount of taxpayers off guard in related party situations is when the “tenant entity” pays the mortgage and property taxes on behalf of the “landlord entity.” The Department of Revenue successfully claims that the tenant’s payment of the debts of the landlord are “constructive rent” subject to sales tax. The situation happens very often and the Department of Revenue has been very successful in not only taxing these situations, but also finding taxpayers who are in this situation.

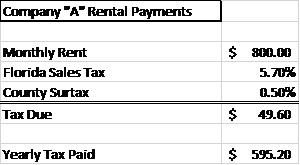

For this example, let’s assume the $800 monthly mortgage obligation of Company A (landlord entity) is paid by Company B (tenant entity) and the property taxes are included in a monthly payment.

Here, whether the tenant entity pays this cost directly or instead pays it to the real estate company, the Department will take the position that tax is due for the year in the amount of $595.20. As such, even when there is no rental agreement between two parties, the Department of Revenue will assess tax when the property expenses are paid directly or indirectly by a business other than the owner of the property.

It is important for taxpayers to understand that the Department can assess up to three years of sales tax if the party is registered with the state. However, if a taxpayer is not registered with the state, the Department can assess all the way back to the beginning of the business. This can create a large tax exposure for the landlord entity even if the tenant entity is filing sales tax returns. Imagine a scenario in which the landlord entity, unregistered with the state, has had the mortgage and taxes on a property paid for by the tenant entity for 20+ years. The Department could assess sales tax plus penalties and interest for the full 20+ years!

The Department of Revenue views commercial rent as an easy to target, as they can search both the county property appraiser’s records and the department of state’s records to identify offending companies. If there are two entities with the same address in the department of state’s records and the owner of the property is not registered as a landlord, then Department of Revenue presume there should be rent. The Department can also compare records of businesses registered with the Department of Revenue to see if the registered company owns the address of record. If not, then the taxing authority can once again see if the owner of the property is registered as a landlord. In not, there is a presumption of taxable rent occurring. Keep in mind, the state can assess both the landlord or the tenant in this scenario. Consequently, both entities should keep accurate records dating back several years or more.

If you or your client are going through an audit and are facing these issues, then there are ways to negotiate down the assessment if you have local, experienced counsel. Depending on your fact pattern, there may even be ways to argue some of the amounts paid should not be considered rent. If you or your client has received an inquiry letter from the Florida Department of Revenue, then there are often things that can be done to help eliminate or mitigate exposure. Even if you or your client knows of an existing commercial rent problem and the state hasn’t started an audit, then there are things that can be done to mitigate the damage. Any position we might be able to argue for you is very fact specific and a free consultation may reveal ways to lower the tax assessment.

About the author: Michael Moffa is a law clerk with Moffa, Sutton, & Donnini, P.A. His primary practice area is multistate tax controversy. Michael received a B.S. in Finance from University of Central Florida in 2015. He attended law school at Barry University where he received his Juris Doctor in 2018. You can read his BIO HERE.

At the Law Office of Moffa, Sutton, & Donnini, PA, our primary practice area is Florida taxes, with a very heavy emphasis in Florida sales and use tax. We have defended Florida businesses against the Florida Department of Revenue since 1991 and have over 100 years of cumulative sales tax experience within our firm. Our partners are both CPAs/Accountants and Attorneys, so we understand both the accounting side of the situation as well as the legal side. We represent taxpayers and business owners from the entire state of Florida. Call our offices today for a FREE INITIAL CONSULTATION to confidentially discuss how we can help put this nightmare behind you.

AUTHORITY

Section 212.031, F.S. Tax on rental or license fee for use of real property

TAA 13A-003 – Rentals of Real Property

US Cardio Vascular Inc vs Florida Department of Revenue, Case No 1D07-3811 (1st DCA, Sept. 23, 2008)

Link to the 1st DCA Opinion: FL DOR v Ruehl, Case No 1D11-2174 - 12-30-2011

Sales and Use Tax on Rental of Living or Sleeping Accommodations

AUTHORITY

FLORIDA NOTICE OF FINAL ASSESSMENT (NOFA) | FL DEPT. OF REVENUE, published December 2, 2018, by Matthew Parker, Esq.

FLORIDA SALES TAX INFORMAL WRITTEN PROTEST, published November 17, 2018, by James Sutton, CPA, Esq.

FLORIDA SALES TAX - VOLUNTARY DISCLOSURE PROGRAM, published April 9, 2018, by Jeanette Moffa, Esq.

FLORIDA USE TAX AUDIT LETTER?, published June 14, 2015, by James Sutton, CPA, Esq. and Jerry Donnini, Esq.

GO TO JAIL FOR NOT PAYING FLORIDA SALES TAX?, published November 3, 2013, by James Sutton, CPA, Esq.