TAA 24A-013 Medical

QUESTION: Are Taxpayer’s Florida sales of the ________________ medical products described below subject to Florida sales and use tax?

ANSWER: Taxpayer’s sales to ________________ in Florida of the ________________, which are all dispensed according to prescriptions written by a licensed practitioner authorized by Florida law to prescribe medicinal drugs and are labeled as test kits, controls, and calibrators, are exempt from Florida sales and use tax.

October 2, 2024

Technical Assistance Advisement – TAA #: 24A-013

________________ (“Taxpayer”)

Sales and Use Tax – Medical

Sections 212.02, 212.05, and 212.08, Florida Statutes - (“F.S.”)

Rule 12A-1.020, Florida Administrative Code - (“F.A.C.”)

BP #: _________

Dear __________________________

This is in response to your letter dated, _________, requesting this Department’s issuance of a Technical Assistance Advisement (“TAA”) pursuant to Section(s.) 213.22, F.S., and Rule Chapter 12-11 F.A.C, Florida Administrative Code, regarding the matter discussed below. Your request has been carefully examined, and the Department finds it to be in compliance with the requisite criteria set forth in Chapter 12-11, F.A.C. This response to your request constitutes a TAA and is issued to you under the authority of s. 213.22, F.S.

REQUESTED ADVISEMENT

Are Taxpayer’s Florida sales of the __________________ medical products described below subject to Florida sales and use tax?

FACTS

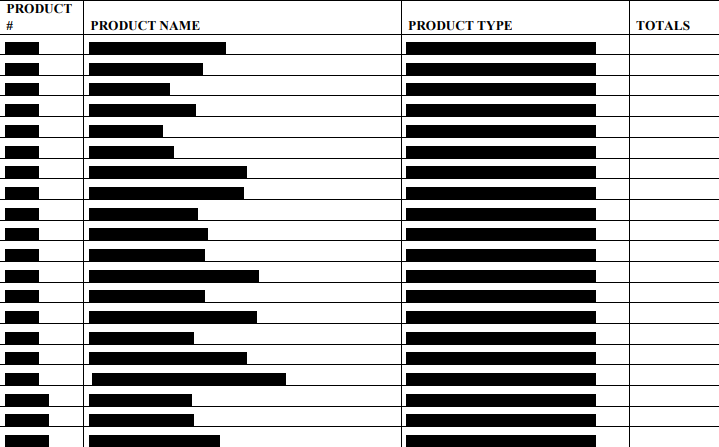

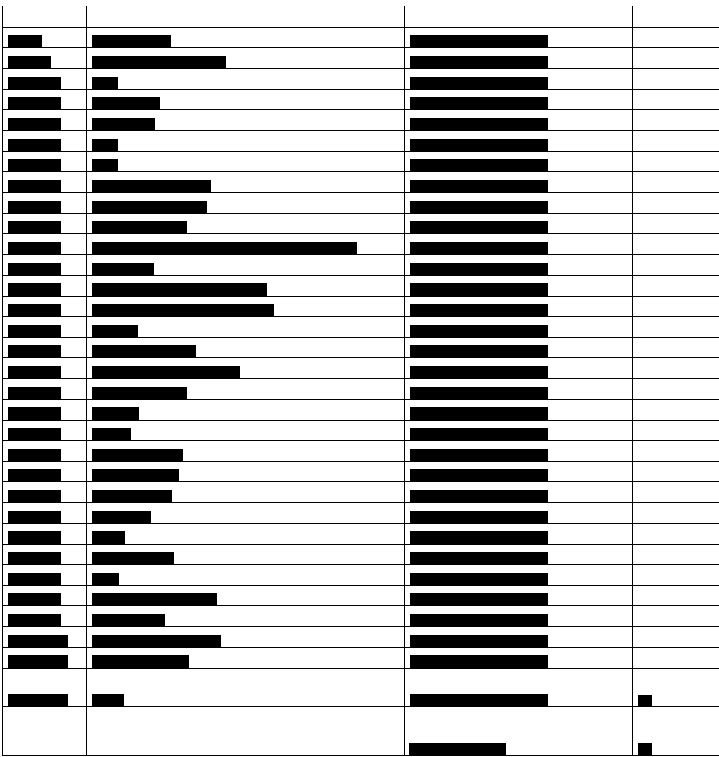

Taxpayer is a registered Florida sales and use tax dealer. Taxpayer is selling various calibrators, test kits, and controls to __________________ in Florida. Taxpayer has asserted that all of the __________________ it is seeking advisement on in this TAA carry _________. Taxpayer has also asserted that none of the products in this advisement are considered to be machines.2

Below is a list of the __________________ under advisement. Taxpayer has classified the __________________ into 3 categories (Calibrators, Controls, and Test Kits).

LAW AND DISCUSSION

Unless a specific exemption applies, s. 212.05, F.S., provides it is the legislative intent that every person is exercising a taxable privilege that engages in the business of selling tangible personal property3 in this state. For exercising such a privilege, a tax is levied on each taxable transaction or incident. The tax is due and payable at the rate of 6 percent, plus any applicable surtaxes imposed under s. 212.055, F.S., on the total consideration received for each item or article of tangible personal property when sold at retail in this state. Exemptions from tax are strictly construed against the claimant. Wanda Marine Corp. v. Dep't of Revenue, 305 So. 2d 65, 69 (Fla. 1st DCA 1975).

Section 212.08(2)(a), F.S., provides in part that there shall be exempt from Florida sales and use tax chemical compounds and test kits used for the diagnosis or treatment of human disease, illness, or injury dispensed according to an individual prescription or prescriptions by a licensed practitioner authorized by Florida law to prescribe medicinal drugs. Further, this section provides an exemption from tax for items that are included on form DR-46NT, Nontaxable Medical and General Grocery List, as approved by the Department of Business and Professional Regulation.

Form DR-46NT, under the heading, “Chemical Compounds and Test Kits,” provides that “chemical compounds and test kits used for the diagnosis or treatment of disease, illness, or injury, dispensed according to an individual prescription or prescriptions written by a licensed practitioner authorized by Florida law to prescribe medicinal drugs are exempt.” In addition, form DR-46NT provides a nonexhaustive list of chemical compounds and test kits for human use which are exempt, with or without a prescription.

Rule 12A-1.020(7)(a), F.A.C., promulgated to administer s. 212.08(2)(a), F.S., provides that blood analyzers, blood collection tubes, and tubes containing chemical compounds, and test kits used to test human blood for detectors of illness, disease, or injury are specifically exempt from tax. However, chemical compounds and test kits that are not used to diagnose or treat human disease, illness, or injury are subject to tax. Rule 12A-1.020(7)(a), F.A.C., also provides the nonexhaustive list of chemical compounds and test kits for human use which are exempt, with or without a prescription.

For the purposes of the statutory exemption found in s. 212.08(2)(a), F.S., the term "chemical compound" is not defined; so, the plain and common meaning of these words must be considered and researched. The term "chemical" is defined as "a substance ... obtained by a chemical process or used for producing a chemical effect.”4 Further the term "compound" is defined as "composed of or produced by the union of several elements, ingredients, parts or things.”5 Hence, a chemical compound would be a substance formed by chemical union of two or more elements or ingredients in definite proportion by weight, via a chemical process, having as a purpose the production of a chemical effect.

Controls are reagents6 which are standards of comparison in scientific experimentation that are used for quality assurance for a particular test that is being conducted. Calibrators are used to determine, check, or rectify the graduation of any instrument or test giving quantitative measurements. Therefore, the control and calibrator products in question fit the description of "chemical compounds" under s. 212.08(2)(a), F.S.

It must now be determined if these controls and calibrators are used for the diagnosis or treatment of human disease, illness, or injury.

Rule 59A-7.029, F.A.C., administered by the Agency for Health Care Administration, provides that laboratories shall establish and follow written quality control procedures for monitoring and evaluating the quality of the testing process of each method to assure the accuracy and reliability of patient test results and reports in accordance with Clinical Laboratory Improvement Amendments7 (CLIA) requirements. The laboratory must utilize test methods, equipment, instrumentation, reagents, materials, and supplies that provide accurate and reliable test results and test reports as required by CLIA.

CLIA are United States federal regulatory standards that apply to all clinical laboratory testing performed on humans in the United States. The CLIA Program sets standards and issues certificates for clinical laboratory testing. CLIA defines a clinical laboratory as any facility which performs laboratory testing on specimens derived from humans for the purpose of providing information for the diagnosis, prevention, or treatment of disease or impairment, and for the assessment of health. A key objective of the CLIA is to ensure the accuracy, reliability and timeliness of test results regardless of where the test was performed.

Since State and Federal regulations both require that a patient’s test results must be validated by the use of calibration material or a control sample, these products are a necessary part of a test kit and the procedure which is used in the diagnosis or treatment of human disease, illness, or injury. As such, they would be exempt from tax as chemical compounds used for the diagnosis of human disease pursuant to s. 212.08(2)(a), F.S.

Taxpayer’s sales of test kits, controls, and calibrators that carry RX prescription labels are exempt from Florida sales and use tax when sold to clinical laboratories in Florida. Section 212.08(2)(a), F.S.

In addition, Taxpayer’s sales of test kits, controls, and calibrators that are for human use are exempt with or without a prescription if such test kits, controls, and calibrators are found on the list provided on form DR-46NT under the heading, Chemical Compounds and Test Kits. For your reference, I have enclosed a copy of form DR-46NT.

CONCLUSION

Taxpayer’s sales to clinical laboratories in Florida of the 86 medical products, which are all dispensed according to prescriptions written by a licensed practitioner authorized by Florida law to prescribe medicinal drugs and are labeled as test kits, controls, and calibrators, are exempt from Florida sales and use tax.

This response constitutes a TAA under s. 213.22, F.S., which is binding on the Department only under the facts and circumstances described in the request for this advice, as specified in s. 213.22, F.S. Our response is predicated on those facts and the specific situation summarized above. You are advised that subsequent statutory or administrative rule changes, or judicial interpretations of the statutes or rules, upon which this advice is based, may subject similar future transactions to a different treatment than expressed in this response.

You are further advised that this response, your request and related backup documents are public records under Chapter 119, F.S., and are subject to disclosure to the public under the conditions of s. 213.22, F.S. Confidential information must be deleted before public disclosure. In an effort to protect confidentiality, we request you provide the undersigned with an edited copy of your request for TAA, the backup material and this response, deleting names, addresses and any other details which might lead to identification of the Taxpayer. Your response should be received by the Department within ten (10) days of the date of this letter.

Leigh L. Ceci, MAcc

Tax Law Specialist

Office of Technical Assistance

(1) Taxpayer’s original TAA request had more than __________________ in which it requested advisement on. However, Taxpayer could only provide labels for __________________. Therefore, this TAA will only opine on the __________________ for which Taxpayer provided sufficient documentation.

(2) Merriam-Webster’s online dictionary defines the term, “machine,” as: a mechanically, electrically, or electronically operated device for performing a task (See https://www merriam-webster.com/dictionary/machine).

(3) Tangible personal property means and includes personal property which may be seen, weighed, measured, or touched or is in any manner perceptible to the senses. See s. 212.02(19), F.S.

(4) Webster's New Collegiate Dictionary, page 189.

(5) Webster's New Collegiate Dictionary, page 229.

(6) Reagents are substances that produce chemical reactions used to detect, examine, or measure a component, or to produce another substance because of its chemical or biological activity.

(7) Clinical Laboratory Improvement Amendments of 1988 and Federal Rules Adopted Thereunder – Section 353 of the Public Health Service Act known as the Clinical Laboratory Improvement Amendments of 1988 and Title 42- Public Health, Chapter IV, Part 493, Laboratory Standards.