TAA 24A-017 Aircraft

QUESTION: As for the aircraft repair exemption, what falls within the definitions of “parts” and “equipment” when used by Taxpayer in the maintenance and repair of a qualified aircraft or an aircraft with a maximum certified takeoff weight greater than 2,000 pounds.

RESPONSE: Based on the plain and ordinary definitions of “parts” and “equipment” - items that constitute a component of the aircraft and/or a set of articles or physical resources that equip the aircraft may be included in the definitions of “parts” and “equipment.”

QUESTION: Whether non-U.S. aircraft are afforded the same repair exemption as aircraft registered in the U.S. If so, how should Taxpayer document the foreign aircraft’s identity to substantiate the aforementioned exemption.

RESPONSE: Yes, equipment and parts installed on aircraft of foreign registry are afforded the same repair exemption. A suggested exemption certificate is provided in Rule 12A-1.007(10)(d)(3), F.A.C., and indicates that the aircraft’s make, model, serial number, registration number and country of registration be documented.

December 2, 2024

Technical Assistance Advisement – TAA #: 24A-017

________________ (“Taxpayer”)

Sales and Use Tax – Aircraft

Section(s) 212.02(19), 212.06 and 212.08, Florida Statutes - (“F.S.”)

Rule(s) 12A-1.007, Florida Administrative Code - (“F.A.C.”)

BP #: __________

Dear Taxpayer:

This is in response to your letter dated __________, requesting this Department’s issuance of a Technical Assistance Advisement (“TAA”) pursuant to Section(s.) 213.22, F.S., and Rule Chapter 12-11 F.A.C, Florida Administrative Code, regarding the matter discussed below. Your request has been carefully examined, and the Department finds it to be in compliance with the requisite criteria set forth in Chapter 12-11, F.A.C. This response to your request constitutes a TAA and is issued to you under the authority of s. 213.22, F.S.

REQUESTED ADVISEMENTS

Taxpayer requests the Department provide guidance on the mechanics of the sales tax exemption for equipment and parts used in aircraft repair and maintenance. Specifically, Taxpayer asks for elaboration on what falls into the definitions or “parts” and “equipment,” and how to properly document such exempt sale to prevent an assessment during an audit.

Taxpayer also asks for advisement as to whether non-U.S. aircraft are afforded the same repair exemption. If so, Taxpayer requests advisement on how to document a foreign aircraft’s identity to substantiate the aforementioned exemption.

FACTS

Taxpayer is a Florida limited liability company that does business in many states. Taxpayer engages in the business of performing various types of maintenance of aircraft, including heavy maintenance, line maintenance, and engine services. In performing such maintenance, Taxpayer sells parts that are incorporated into the aircraft it is repairing. The aircraft usually have a maximum certified takeoff weight of greater than 2,000 pounds or less than 10,000 pounds and otherwise meet the definition of qualified aircraft under Florida Statutes.

Taxpayer recently became aware of the sales tax exemption for replacement parts and equipment used in the repair or maintenance of certain aircraft. Unaware of which items are exempt and how to document a transaction’s exempt status, Taxpayer has continued to collect sales tax on all transactions. Taxpayer requests advisement on how to properly document the sales tax exemption for parts and maintenance of certain aircraft.

TAXPAYER’S POSITION

It is Taxpayer’s position that all parts, materials, and labor used by Taxpayer in the repair or maintenance of a qualified aircraft with a maximum, certified takeoff weight greater than 2,000 pounds including, structural fittings, batteries, wheels, bolts, screws, windows, and panels are exempt from sales and use tax pursuant to s. 212.08(7)(ee) and (rr), F.S. These items qualify as “parts” or “equipment” under the standard definition of each word. During the installation of these items, Taxpayer also incorporates other ancillary materials, such as paint, sealant, oil, or other fluids, which you state qualify as “equipment” and “parts,” which are part of the set used for a particular purpose and are a component that combines with other pieces to form a whole.

Included with your request was an invoice for repairs of an aircraft billed to Freedom II, which you state substantiates the claim that Taxpayer performs maintenance work for qualified aircraft.

LAW AND DISCUSSION

Section 212.06(8)(a), F.S., provides that generally, when tangible personal property1 is imported into Florida within six months of the date of purchase, the property is subject to the Florida use tax.

Labor and Equipment

Section 212.08(7)(ee), F.S., specifically exempts from tax, all labor charges for the repair and maintenance of qualified aircraft2 and aircraft of more than 2,000 pounds maximum certified takeoff weight, including rotary wing aircraft. Additionally, s. 212.08(7)(rr), F.S., exempts from sales tax - replacement engines, parts, and equipment used in the repair or maintenance of qualified aircraft and aircraft of more than 2,000 pounds maximum certified takeoff weight, including rotary wing aircraft, when such parts or equipment are installed on aircraft that is being repaired or maintained in Florida.

Section 212.08(5)(i), F.S., provides that “[t]here shall be exempt from sales tax all charges for aircraft modification services, including parts and equipment furnished and installed in connection therewith, performed under the authority of a supplemental type certificate [(STC)] issued by the Federal Aviation Administration [(FAA)].”

* * *

Rule 12A-1.007(10)(f), F.A.C., further provides that the aircraft modifications subject to this exemption are those which introduce a major change in type of design not great enough to require a new application for a type certificate, as provided by Aeronautics and Space, 14 C.F.R. §21.113 (March 5, 2018), effective January 1, 2020, incorporated into the rule by reference (http://www.flrules.org/Gateway/reference.asp?No=Ref-13419).” To document the exemption of the qualifying modification, copies of the FAA STC and FAA Form 337 containing a description of the major change, signed by a holder of an FAA inspection authorization, must be maintained in the dealer’s and purchaser’s books and records.

Foreign Aircraft

Section 212.06(5)(a)1., F.S., provides that it is not the intention to levy Florida sales tax upon purchases of parts and equipment installed on aircraft of foreign registry and that will not be operated in the United States. Parts and equipment used in the repair, alteration, refitting, or modification of an aircraft for foreign customers are exempt from tax provided the aircraft is registered outside of the United States and will depart from the United States upon completion of the repairs, alterations, refitting, or modification. To be eligible for this exemption, Taxpayer must obtain an exemption certificate from the aircraft’s owner, agent, or operator indicating that the aircraft was brought to the United States for the purpose of having equipment and parts installed and that upon completion of the repairs, alteration, refitting, or modification the aircraft will depart under its own power from the continental United States.

Rule 12A-1.007(10)(d)2., F.A.C., states that “[e]quipment and parts installed on aircraft of foreign registry are subject to tax, unless the owner, owner’s agent, or operator of the aircraft furnishes the dealer with an exemption certificate stating the aircraft was brought to the United States for the purpose of having equipment and parts installed and that upon completion of such installation, the aircraft will depart under its own power from the continental United States. The burden of obtaining this evidential matter rests with the dealer installing the equipment and parts, who must retain the proper documentation to support the exemption.”

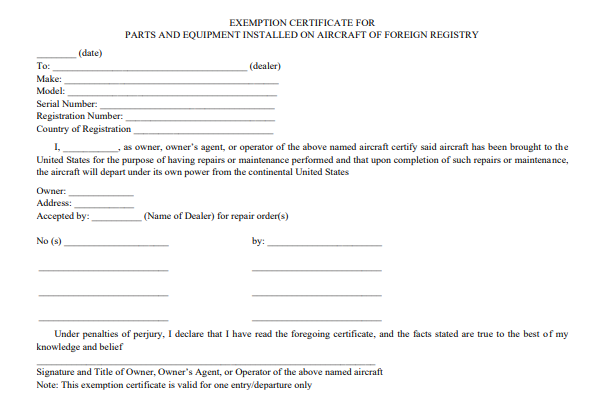

The following suggested exemption certificate to be collected by a Florida dealer installing parts and equipment on an aircraft of foreign registry is provided in Rule 12A-1.007(10)(d)(3), F.A.C.

The terms “parts” or “equipment” are not defined in the Florida Statutes nor Florida Administrative Code. Where a word is not defined by statute or the intent of the word’s usage is unclear, a court would resort to principles of statutory construction and may determine the plain and ordinary meaning of the word from the dictionary. See Nehme v. Smithkline Beecham Clinical Labs., Inc., 863 So. 2d 201, 204-05 (Fla. 2003) (quoting Seagrave v. State, 802 So. 2d 281, 286 (Fla. 2001)). The term “parts” is defined as “… a constituent member of a machine or other apparatus. …” (2024, September 12). Merriam-Webster. https://www.merriamwebster.com/dictionary/parts). “Equipment” is defined as “the set of articles or physical resources serving to equip a person or thing …” (2024, September 12). (Merriam-Webster. https://www.merriam-webster.com/dictionary/equipment).

As provided in the above-cited statutory and regulatory provisions, the purchase of replacement engines, parts, equipment and labor used in or for the repair and maintenance of fixed wing or rotary wing aircraft of more than 2,000 pounds maximum certified takeoff weight are exempt from Florida sales and use tax. Dealers who make sales of replacement engines, parts, equipment and labor that qualify for the exemption must document the N-number, (in the case of aircraft of foreign registry, the make, model, serial number, registration number and country of registration) and the maximum takeoff weight of the eligible aircraft on the bill or sale, invoice, or other tangible evidence of the sale. Additionally, charges for aircraft modification services including parts, equipment and labor furnished or installed under an STC issued by the FAA for specifically installed equipment are exempt from Florida sales and use tax.

In this case, Taxpayer operates as an approved Part 145 repair station in Florida. During its performance of repair and maintenance, Taxpayer installs parts and equipment including but not limited to structural fittings, batteries, wheels, bolts, screws, windows, and panels as well as incorporates paints, sealants, oils, or other fluids. Based on the plain and ordinary definitions of the terms parts and equipment, these items constitute a component of the aircraft and/or a set of articles or physical resources that equip the aircraft and when used during the repair and maintenance of aircraft with a maximum certified take-off weight that exceeds 2,000 pounds – would qualify for the sales tax exemption, so long as the Taxpayer properly documents the transaction. To claim and document the exemption, Taxpayer should note the FAA N-Number and the maximum certified takeoff weight of the eligible aircraft on the bill of sale. When the aircraft is of foreign registry, Taxpayer should note the make, model, serial number, registration number and country of registration.

CONCLUSIONS

QUESTION: As for the aircraft repair exemption, what falls within the definitions of “parts” and “equipment” when used by Taxpayer in the maintenance and repair of a qualified aircraft or an aircraft with a maximum certified takeoff weight greater than 2,000 pounds.

RESPONSE: Based on the plain and ordinary definitions of “parts” and “equipment” - items that constitute a component of the aircraft and/or a set of articles or physical resources that equip the aircraft may be included in the definitions of “parts” and “equipment.”

QUESTION: Whether non-U.S. aircraft are afforded the same repair exemption as aircraft registered in the U.S. If so, how should Taxpayer document the foreign aircraft’s identity to substantiate the aforementioned exemption.

RESPONSE: Yes, equipment and parts installed on aircraft of foreign registry are afforded the same repair exemption. A suggested exemption certificate is provided in Rule 12A-1.007(10)(d)(3), F.A.C., and indicates that the aircraft’s make, model, serial number, registration number and country of registration be documented.

This response constitutes a TAA under s. 213.22, F.S., which is binding on the Department only under the facts and circumstances described in the request for this advice, as specified in s. 213.22, F.S. Our response is predicated on those facts and the specific situation summarized above. You are advised that subsequent statutory or administrative rule changes, or judicial interpretations of the statutes or rules, upon which this advice is based, may subject similar future transactions to a different treatment than expressed in this response.

You are further advised that this response, your request and related backup documents are public records under Chapter 119, F.S., and are subject to disclosure to the public under the conditions of s. 213.22, F.S. Confidential information must be deleted before public disclosure. In an effort to protect confidentiality, we request you provide the undersigned with an edited copy of your request for TAA, the backup material and this response, deleting names, addresses and any other details which might lead to identification of the Taxpayer. Your response should be received by the Department within ten (10) days of the date of this letter.

Shundra McClean

Tax Law Specialist

Office of Technical Assistance

(1) Tangible personal property means and includes personal property which may be seen, weighed, measured, or touched or is in any manner perceptible to the senses. See s. 212.02(19), F.S.

(2) Section 212.02(33), F.S., defines “qualified aircraft” as “any aircraft having a maximum certified takeoff weight of less than 10,000 pounds and equipped with twin turbofan engines that meet Stage IV noise requirements that is used by a business operating as an on-demand air carrier under Federal Aviation Administration Regulation Title 14, chapter I, part 135, Code of Federal Regulations, that owns or leases and operates a fleet of at least 25 of such aircraft in this state.”