TAA 25A-009 Parking Ticket Violation Fee

QUESTION: Whether the violation fee found on a parking ticket receipt is not subject to Florida sales and use tax?

ANSWER: Sales tax was collected on the $20.00 transaction. In Volusia County, the applicable sales tax rate is 6.5%. which would result in $1.30 in tax ($20.00 x 6.5%). The $50.00 violation is not subject to sales tax.

October 27, 2025

Technical Assistance Advisement – TAA #: 25A-009

________________ (“Taxpayer”)

Sales and Use Tax – Parking Ticket Violation Fee

Sections 212.02(10)(i), 212.03(6), 213.22, Florida Statutes - (“F.S.”)

Rules 12A-1.073, Florida Administrative Code - (“F.A.C.”)

BP#: ________________

Dear ________________ :

This is in response to your letter dated ________________ requesting this Department’s issuance of a Technical Assistance Advisement (“TAA”) pursuant to Section(s.) 213.22, F.S., and Rule Chapter 12-11 F.A.C, Florida Administrative Code, regarding the matter discussed below. Your request has been carefully examined, and the Department finds it to be in compliance with the requisite criteria set forth in Chapter 12-11, F.A.C. This response to your request constitutes a TAA and is issued to you under the authority of s. 213.22, F.S.

REQUESTED ADVISEMENT

You are seeking confirmation on whether the violation fee found on a parking ticket receipt is not subject to Florida sales and use tax.

FACTS

Your letter states:

Taxpayer manages over ________________ parking spaces for private and public clients. It offers customized, creative, and responsive services to maximize parking capacity and tenant satisfaction. Taxpayer operates in over ten different states, including ________________________________________________ ________________________________.

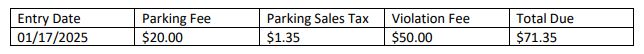

Taxpayer submitted Exhibit A, which is the Volusia County Parking Division Notice of Parking Violation (hereinafter referred to as the “Notice”). The citation details are as follows: the Notice has a parking fee of $20.00, a sales tax of $1.35 on the $20.00, and a violation fee of $50.00, thus bringing the total amount due to $71.35. The ticket expressly indicates the ticket was given as a result of a vehicle entering the Volusia County parking facility on January 26, 2025, and payment for stay, as required for use of the facility, was not received. The citation indicates if the amount is not paid before February 25, 2025, there will be an additional $50.00 late fee charged to the account.

The taxpayer’s representative, upon inquiry, confirmed that this request only concerns motor vehicle parking lots and garages.

TAXPAYER’S POSITION

Taxpayer believes, every person who leases or rents parking or storage spaces for motor vehicles in parking lots or garages, including storage facilities for towed vehicles, who leases or rents docking or storage spaces for boats in boat docks or marinas, or who leases or rents tie-down or storage space for aircraft at airports is engaging in a taxable privilege. Section 212.03(6), (F.S.). A license is the granting of a privilege to use or occupy a building or a parcel of real property for any purpose. Section 212.02(10)(i), F.S. Therefore, the license to park in the designated Volusia County parking facility in Florida is subject to sales tax. However, there are certain items that are not subject to sales tax.

It is a well-settled principle of Florida law that taxing statutes are construed against the State. See Harbor Ventures, Inc. v. Hutches, 366 So.2d 1173, 1174 (Fla. 1979); Maas Bros. v. Dickinson, 195 So.2d 193, 198 (Fla. 1967); Dep’t of Revenue v. Quotron Systems, Inc., 615 So.2d 774, 778 (Fla. 3rd DCA 1993) (stating “[a]s is the law with all taxing statutes, the Department has the burden of proof. In this case, the Department must establish that Quotron's transactions are within the ‘clear definite boundaries’ of the statutory definition of a ‘sale’ of ‘tangible personal property’ subject to Florida sales tax.”). This ambiguity standard in Florida caselaw is not limited to statutory interpretation. It also is applicable to determining whether a transaction is subject to Florida sales and use tax in the first place, as the Department has the burden to prove transactions are subject to tax. E.g., Leadership Housing, Inc. v. Dep’t of Revenue, 336 So.2d 1239, 1242 (Fla. 4th DCA 1976). If there is any doubt as to whether an item is taxable, the ambiguity is to be resolved in favor of the taxpayer. Id.

While there is not a specific statute or rule speaking to violation fees, there are similar examples to which it can analogous. The example of the violation fee can be compared to Rule 12A-1.007(13)(e)1., F.A.C., which specifies separately stated insurance covered at the option of the customer are not subject to sales tax.

Similarly, the Notice has a parking fee of $20.00, which is subject to sales tax because the parking fee is a charge for parking and is required. However, the violation fee of $50.00 should not be subject to sales tax, because the violation fee is avoidable at the option of the customer and is separately itemized. For these reasons, the violation fee is not subject to sales tax.

LAW AND DISCUSSION

Section 212.03(6), F.S., states that it is the legislative intent that “every person who leases or rents parking or storage spaces for motor vehicles in parking lots or garages, . . . is engaging in a taxable privilege.” For the exercise of this privilege, a tax at the rate of 6 percent applies to the total rental charged. (See also Rule 12A-1.073, F.A.C.). The taxability of the charge for parking is not disputed. Rather, the question is whether the “violation fee” – in this specific instance for nonpayment – is also subject to tax. The Notice provides in addition that there is a late fee if the Notice is not paid in full by a specified date.

The “Notice of Parking Violation” presents as follows:

Chapter 212, F.S., provides that the “sales price” of a taxable transaction includes “services that are a part of the sale.” It is clear in this instance that violation fee and any appropriate late fee do not constitute additional services provided to the customer.

Similar charges, in relation to the sale or rental of tangible personal property, were considered in Dept. of Revenue v. B & L Concepts, 612 So.2d 720 (Fla. 5th DCA 1993). In B & L Concepts, the taxpayer rented appliances, furniture, and home entertainment products and charged a late fee for items returned after the agreed date. The taxpayer also charged for the delivery of rented items. The Court found that such charges were “incidental” to the sale and held that if these charges or fees are separately itemized and applied at the sole option or election of the vendee or lessee, or could be avoided by decision or action

The taxpayer is correct in pointing out that there is no statute or rule that speaks directly to the charges in question relating to parking or storage of motor vehicles. However, analogous charges were considered in B & L Concepts and by the following rules:

- Rule 12A-1.045(4)(a), F.A.C., provides that charges for “transportation charges” (carrying, delivery, freight, handling, pickup, shipping, and similar charges or fees) are not subject to tax when: the charge is separately stated on an invoice or bill of sale; and, the charge can be avoided by a decision or action solely on the part of the purchaser.

- Rule 12A-1.007(13)(e)1., F.A.C., regarding the lease or rental of motor vehicles, provides that separately itemized charges or fees for insurance coverage required to be paid by the lessee when the lessee or renter has the option to elect the insurance coverage is not subject to tax.

Consistent with the rules and decision identified above and mindful that tax must clearly be shown to apply, this advisement determines that when, as here, the Violation Fee is separately stated and can be avoided by a decision or action of the car owner – namely, paying the parking fee at the time of the stay – such charge is not subject to sales and use tax.1

CONCLUSION

In this instance, tax should not be imposed upon the separately stated violation fee. Based on the facts provided, sales tax was collected on the $20.00 transaction. In Volusia County, the applicable sales tax rate is 6.5%. which would result in $1.30 in tax ($20.00 x 6.5%). The $50.00 violation is not subject to sales tax. Please refer to our Discretionary Sales Surtax Information form DR15DSS and Tax Information Publication 21A01-02 for further guidance.

This response constitutes a TAA under s. 213.22, F.S., which is binding on the Department only under the facts and circumstances described in the request for this advice, as specified in s. 213.22, F.S. Our response is predicated on those facts and the specific situation summarized above. You are advised that subsequent statutory or administrative rule changes, or judicial interpretations of the statutes or rules, upon which this advice is based, may subject similar future transactions to a different treatment than expressed in this response.

You are further advised that this response, your request and related backup documents are public records under Chapter 119, F.S., and are subject to disclosure to the public under the conditions of s. 213.22, F.S. Confidential information must be deleted before public disclosure. In an effort to protect confidentiality, we request you provide the undersigned with an edited copy of your request for TAA, the backup material and this response, deleting names, addresses and any other details which might lead to identification of the Taxpayer. Your response should be received by the Department within ten (10) days of the date of this letter.

Alesia L. Pride

Tax Law Specialist

Office of Technical Assistance

1) It is noted that the same analysis would apply to a separately stated late fee, when applicable.